Market Continuations and Reversals Thread with a focus on Bear Market Rallies

Topics Covered: Tread on Momentum, Trend, Mean Reversion, Turning Points, Dead Cat Bounces, Bear Market Rallies, Exhaustion Points.

Disclosure: Salute to WifeyAlpha, all the resource is from him. Show him support by follow: https://twitter.com/WifeyAlpha. Everything in here is not mine, i’m just good at finding alpha, alpha is everywhere.

Im quite interested in momentum and trading high volatile asset. After one month of researching, back-testing, and lost a quite amount of money for testing, I can say that now i’m trading systematically, this help me with my psychology, I don’t care about the trend, I dont care about long-term, timing is everything. I care about how it’s should fit my system, how the mean-reversion of the trend, the mean-reversion of the fund flow, all that sort of things. Lot to learn, work harder..

A lot of those things is not mine mostly. I put it in here for future use.

What's the difference between momentum and trend following?

(Source: Two Sigma, 2020) Trend Following is meant to capture momentum, using the trailing returns of macro asset classes.

Trend following sounds a lot like the Momentum equity style factor. In fact, the two have a positive long-term correlation of 0.3. How are these two factors different, and why does it matter?

Difference #1: The Underlying Asset Class The first, most obvious difference between the two is the asset classes used to construct each factor. Momentum is an equity style factor that is built using individual stocks - so it could be long Apple and short Alphabet.

Trend Following is a macro style factor and is therefore built using derivatives ( like futures and forwards) or ETFs in several macro asset classes: equities, fixed income, currencies, and crypto, commodities -- so it could be long an ES contacts and short a gold futures.

Difference #2: Cross-Sectional vs. Time Series Momentum The second, and arguably the most important, difference between the two factors is the type of momentum that they are capturing.

The Momentum equity style factor is constructed cross-sectionally, meaning an asset’s momentum is compared to the momentum of other assets. Trend Following, on the other hand, is constructed using time series momentum, which focuses purely on an asset’s own past returns.

This has an important implication: the Momentum factor will be market neutral to global equity markets at all times, while the Trend Following factor can take on conditional (positive or negative) correlation in any of the five asset classes mentioned above, it should not demonstrate meaningful correlation to those asset classes over a full market cycle. Here’s a simple example that showcases the difference between cross-sectional and time series momentum. Imagine you are constructing a momentum factor using only two assets.

A cross-sectional momentum implementation would buy Asset 1 and sell Asset 2 because Asset 1 outperformed Asset 2. Notice how the long-short factor would be market neutral to whatever market Assets 1 and 2 belong to.

A time series momentum implementation would sell both Assets 1 and 2 because they both have exhibited negative momentum. This would lead, at least over the short-term, to a negative correlation with the market that Assets 1 and 2 belong to.

In practice and in academic literature, cross-sectional momentum is applied more so across single-name equities than macro assets. The reason being that there are thousands of single-name equities versus roughly one hundred macro assets spanning various asset classes.

Therefore, the greater breadth of the equities universe allows for greater diversification as well as more opportunities for apples-to-apples comparisons, for examples, performance trends of Microsoft versus Google is a more clear comparison versus performance trends of the SPY compared to the Taiwanese dollar).

Difference #3: The Lookback Period The final major difference between the two factors concerns the lookback period used to determine the momentum of an asset. The Momentum equity style factor considers the stock’s performance over the past 1, 3, 6, and 12 months, whereas the Trend Following macro style factor considers the contract’s performance over the past 1 and 3 months and over the past 6 and 12 months (the two lookback periods are equally-weighted).

The reason for the shorter-term component to Trend Following is that in practice, macro trend followers and Commodity Trading Advisors (or CTAs) tend to focus on shorter horizons due to the abundant liquidity and capacity of the underlying macro derivatives that they trade.

Conclusion In summary, the two factors are certainly related - they both intend to capture momentum, or the tendency for an asset to persist in its relative (or absolute) performance. However, we believe it’s important to include both factors in a risk model, as they will tend to show up for different reasons. The Momentum equity style factor can appear in equity market neutral, long-short equity, or even long-only stock funds, especially when the latter is compared relative to its benchmark.

Trend Following macro style factor can appear in trend followers, global macro managers, or CTAs. If you have a mix of these types of strategies in your portfolios you will benefit from diversification and it will be important for allocators evaluating multi-strategy PMs.

Source

Understanding Momentum and Reversals (AQR, 2020) https://t.co/cGaxPXhdxJ

Short Term Trading Models – Mean Reversion Trading Strategies and the Black Swan Events (World Quant, 2020) https://t.co/RF1wdzyWyL

As Dario Villani says you have two factors “you have momentum and you have some mean reversion everything else is up to interpretation.” https://t.co/z6SEPMw985

Nowcasting business cycle turning points with stock networks and machine learning (ECB, 2020) https://t.co/VqNS6zoHOw

A very interesting about Dual momentum investing: Accelerating Dual Momentum Investing using multi momentum timeframe signals https://t.co/lYw1fAwoC7

To Trend or to Revert - A Portfolio Perspective on Time Series Momentum (Nomura, 2020) https://t.co/rHJONUGIEV

To support timing, Momentum Turning Points (Research Affiliates, 2019) https://t.co/K7Bs7DtXL3

The Meaning of Market Efficiency (Jarrow & Larsson, 2011) https://t.co/32B42JY0nq

Slow Momentum with Fast Reversion: A Trading Strategy Using Deep Learning and Changepoint Detection (2021) https://t.co/tpPoUZPmJ3

Interesting find of the week

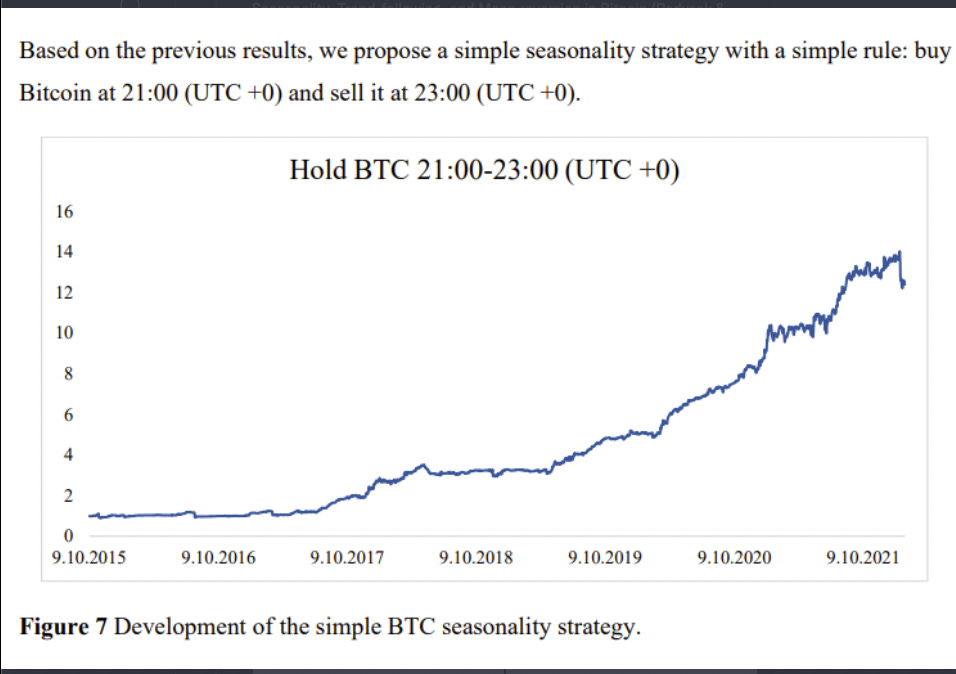

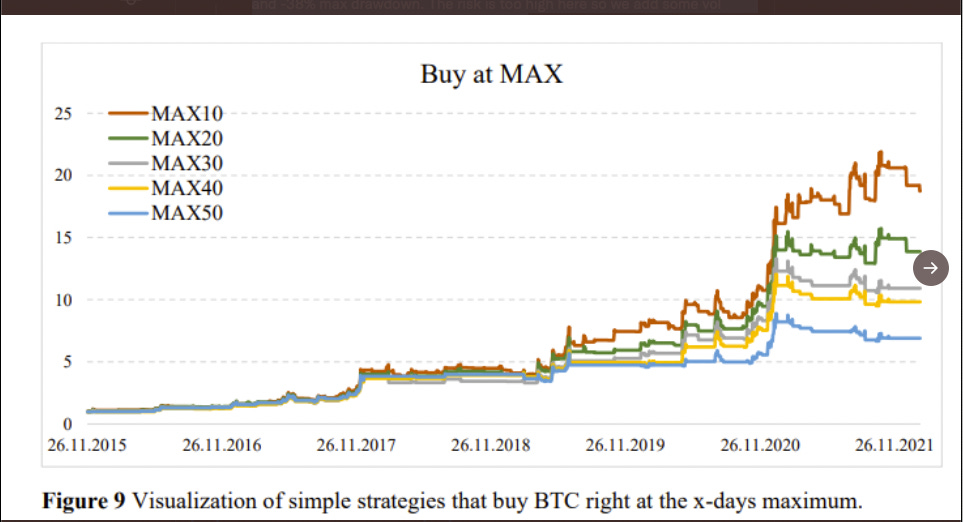

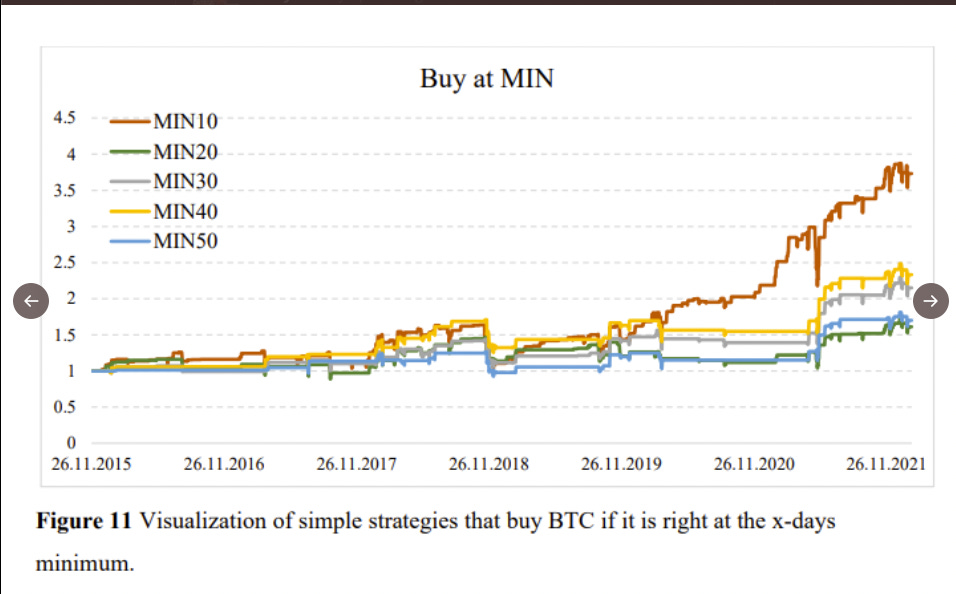

Seasonality, Trend-following, and Mean reversion in Bitcoin (Padysak & Vojtko, 2022) https://t.co/5vkEdS0YWS

Yes, that’s strategy should work. I have tried that. The Max Min strategy has annual return of 98% for 48% annual volatility and -38% max drawdown. The risk is too high, so I need to tinkering it’s with my system already established.